Earn Bounties Instantly on Every Purchase with Anq!

Bounties Offer: Spend Rs 9900 on X Card and get Rs 99 as bounties instantly! Rs 1.5 for every Rs 150!

Offer valid till: Perpetually, until notified otherwise. Unconditional!

What are Bounties?

"Forget "earn while you sleep." Earn while you live, breathe, and shop with Bounties!"

Imagine buying groceries and instantly seeing your gold stack grow. That's the power of Bounties.

Bounties help you build wealth, no matter what the economy throws your way, especially in times when inflation and excessive money printing threaten to erode your savings each year.

Bounties are your like a tiny daily investment, every purchase adds up, as every small contribution counts when it comes to growing your wealth over time. We aim to help our customers break free from the never-ending financial rat race by turning everyday spending into automatic wealth-building with Bounties.

How do Bounties work?

Bounties are essentially designed to be uncapped, immediately allocated and flat in nature (Rs 1.5 on each Rs 150 spent using X card and using Anq Shopping you get up to 16% on various brands) for easier calculation on each transaction, and create reliability in our customer's mind. We have tried our best to make it happen.

Why uncapped - this is the moment of truth. Most debit cards today have rewards capped in disclaimers, which we don't. Our goal is to enrich our customers, so that they can build wealth.

Second, since Bounties are allocated the moment you spend, the moment you spend, you are investing into an asset for your future. If monthly SIPs were a good way to de-risk 'timing the market', daily Bounties can help you remove all thought of 'timing the market'. Just spend everyday, and your Bounties will compound.

Why are Bounties locked?

Bounties start in a locked format as transactions often get refunded and reversed. To calculate Bounties correctly, so that only successful transactions get rewarded, we lock your Bounties.

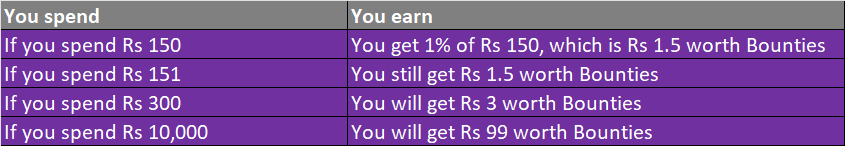

How does Rs 1.5 on each Rs 150 get calculated?

It is easier to explain with an illustration:

But, no fuel waiver?

However, we don't give fuel waiver, we give 1% bounties on that transaction. Net for a customer, it works to be same (1% fuel surcharge waiver or 1% Bounties) but instead of getting cash, customer is getting Bounties.

In a nutshell

Whenever you use Anq, we will try our best to:

1) Build your wealth, power wealth creation. Every paisa counts.

2) Hopefully your wealth grows, you become rich. (Do remember us then).

3) You win.

For all the difficult issues that our customers are facing, we are trying our best to fix them, and our support team is always available for you to reach out at help@anq.finance.