Anq - Simplifying rewards on cards

Simplify Payments - Maximize your rewards with X card and earn even more through Anq Shopping.

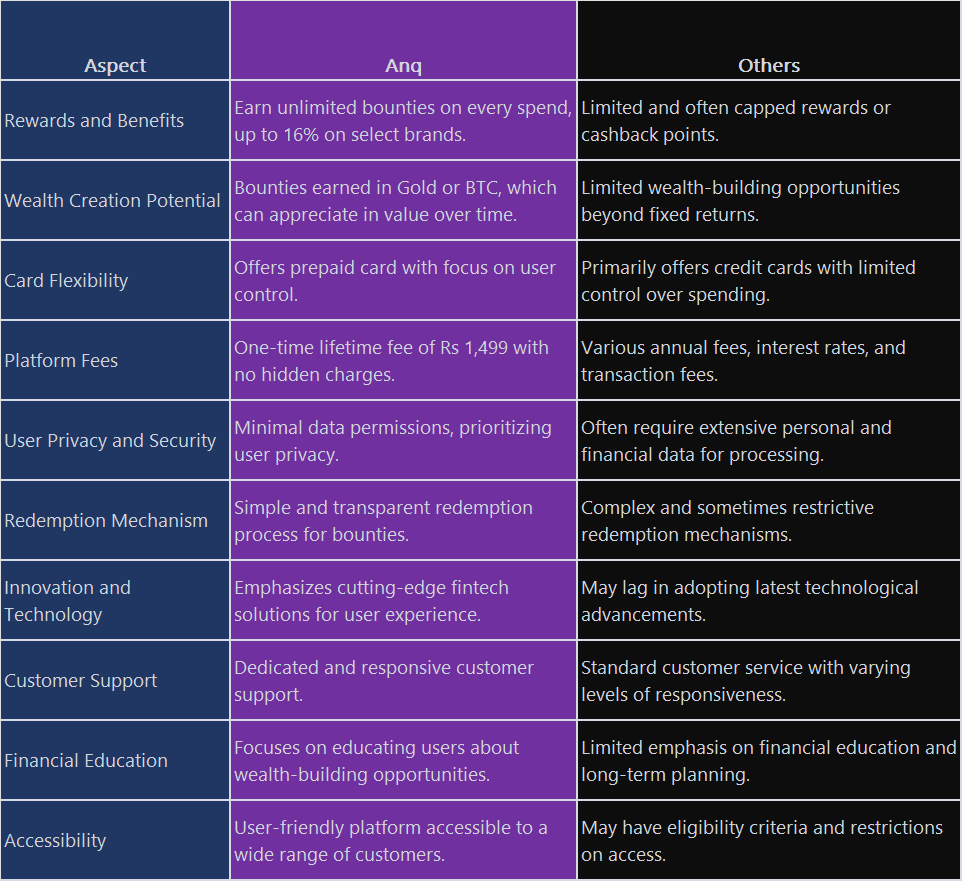

Most of the payment methods are convenient but unrewarding. Anq is convenient but superbly rewarding.

Rewards earned on most transactions - Better luck next time and at best 1-3 Rupees on scratch card or useless coupon codes.

Rewards earned on Anq ?

1% unlimited, uncapped rewards on multiple of Rs 150 on every spend. That means on every spend.

Upto 16% on various other shopping vouchers. Yes, you heard it right. To name a few: Swiggy - 7%, Zomato 7.5%, MakeMyTrip 3.5%, Nykaa - 4%, Pentaloons - 9% and so on over 200+ brands. No minimum spend and no maximum cap.

Wow - But are these points useless again with some tricky redemption mechanism?

Absolutely not! These rewards are in Gold or BTC. For example, if you spend INR 10k on a Zomato voucher, you will receive Rs 750 worth of Gold or BTC at that point in time. Since these rewards are market-linked, their value may appreciate based on the market. Historically, this has been the case, making them excellent investments to beat inflation.

But why Gold or BTC - or as we call them, Bounties - and not cashback points or rewards points or some random points.

Well, as a consumer, we have faced this before, just to give you an example:

Spend 50k a month, accumulate some points, and that too with caps on every transaction - from minimum transaction value to the maximum points I can earn on a spend, all capped. By the time I accumulate these reward points to a level where I can redeem them, boom - each reward point is only worth .xx rupees. That's all? Nope - the next bouncer is that the value has already depreciated due to inflation, let's say by 10%. Then I have to find a way to redeem against something I love, and even if it works, well, I have something. Oh, and meanwhile, some points may expire in between without me noticing. To be fair, banks sometimes share emails, but unfortunately, it's tough to notice and act every time. Hence, we decided to be transparent and provide rewards in an asset that may appreciate in value, can be redeemed easily, with no expiry, no caps, etc. Well, as a consumer, if we can't use it, who else would?

But then X card is a prepaid card and not credit card.

You are absolutely right. While we will also be launching a credit card soon, we deliberated and decided that many of us are:

- Still not credit card users

- Prefer to have control over our spending

- Primarily use credit cards for the rewards they offer

But what if all of these concerns could be addressed by one particular product? That's when we decided to launch a prepaid instrument to cater to a larger audience. It is undeniable that credit cards come with their benefits, and we are actively working on offering them to our valued Anq customers without any additional charges.

But then why there is a platform fees on Anq ?

At our company, we firmly embrace the age-old adage: if a product is free, then the product is you. As such, we charge a reasonable fee to ensure that you are not treated as a commodity, but instead can fully experience and benefit from our exceptional financial products and services.

For a one-time lifetime fee of just Rs 1,499, you can gain access to our platform without worrying about annual maintenance fees or any hidden charges. We prioritize your privacy by refraining from requesting permissions such as SMS or call logs, which could compromise your data in exchange for a free product.

Moreover, our enticing rewards program guarantees that the average user will quickly recoup their investment. Our typical user recovers the onetime lifetime fees in less than 40 days. The earliest have been in less than 3 hours. And we are not kidding.

But why charge upfront ?

Let's understand this: when a user gets onboarded, there are expenses that any organization incurs. We are no different. By having platform fees upfront, we keep our costs to a minimum and, as a result, can offer significantly higher returns without becoming unsustainable.

But would this remain like this forever or it's a marketing tactics ?

It will remain like this, forever. And that's how it's been designed. Does this mean reward bounties on X card will go down? Never. Reward bounties on brands will go down? Mostly no, but sometimes brands' pricing goes up and down. So while some may see downside correction, others will see upside, but the overall value proposition will remain intact. That's our commitment.

With 30k+ downloads and counting, Anq will always be India's most rewarding financial experience. A lot is cooking, and stay tuned for more exciting updates!

Join Anq now and since you spend sometime reading this, here is the discounted link for you ! See you building wealth with one bounty at a time on every spend every time.

https://anqapp.app.link/ANQSOCIAL