The Savvy Choice: Why Prepaid Cards Outperform Credit and Debit Cards

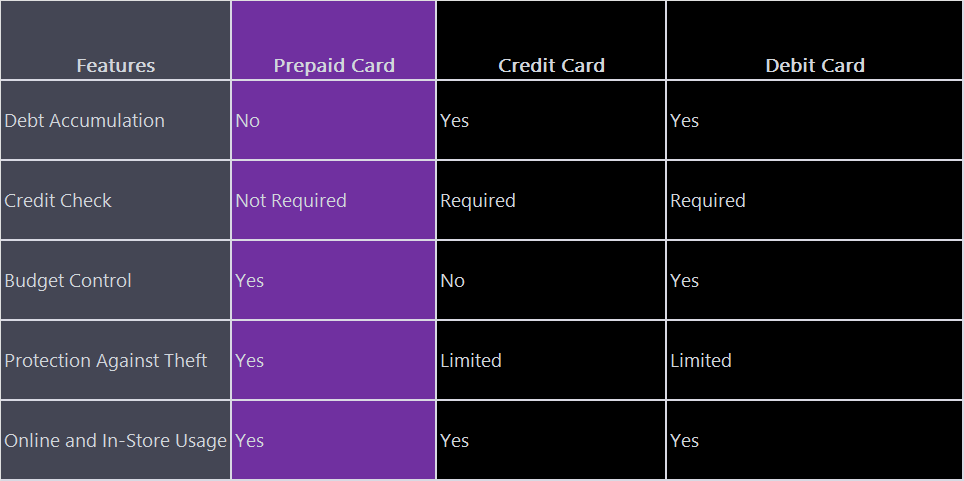

In the realm of financial tools, prepaid cards have emerged as a superior choice for the savvy consumer. With their distinct advantages over credit and debit cards, prepaid cards offer a smart and secure way to manage finances. Let's delve into the reasons why the savvy individual should opt for a prepaid card and explore a comparison table highlighting the key differences.

- No Debt Accumulation: Prepaid cards operate on a "pay-as-you-go" principle. Users can only spend the available funds loaded onto the card, eliminating the risk of accumulating debt, as is the case with credit cards. For the financially savvy, avoiding interest charges and maintaining financial discipline are essential aspects of smart money management.

- No Credit Checks: Obtaining a prepaid card doesn't require a credit check, making it an accessible option for those without a robust credit history or those looking to separate their spending from credit reporting. This ensures that the savvy user can retain control over their finances without worrying about potential credit score impacts.

- Budget-Friendly: Prepaid cards empower users to set spending limits. By preloading a specific amount, individuals can manage their budget effectively and prevent impulsive purchases, which is a common pitfall with credit cards. The ability to stay within a pre-defined budget aligns with the prudent financial approach.

- Enhanced Security: Prepaid cards offer an additional layer of security, safeguarding against unauthorized transactions. Unlike debit cards, which are linked to bank accounts, prepaid cards have limited exposure in case of theft or loss. The savvy consumer values such added protection to mitigate potential risks.

- Versatile Usage: Prepaid cards can be used for online and in-store transactions, just like credit and debit cards. They offer seamless utility without the risk of dipping into credit lines or incurring overdraft fees, providing peace of mind for the savvy spender.

For the savvy individual seeking financial control, security, and budget management, prepaid cards present a superior choice compared to credit and debit cards. By avoiding debt accumulation, bypassing credit checks, and providing enhanced security, prepaid cards empower users to stay within their budget and make prudent financial decisions. Embracing the prepaid card option is a testament to financial wisdom and a step towards a more secure and responsible financial journey.

X Card by Anq, as a prepaid card, epitomizes the epitome of the savvy consumer's financial journey. With its unique features and benefits, the X Card aligns perfectly with the values of the financially prudent. By offering a prepaid model, X Card ensures that users have complete control over their spending. The ability to load funds onto the card, without the risk of credit check or debt accumulation, grants the user unmatched financial autonomy. X Card's flexibility in setting spending limits, coupled with seamless online and in-store usage, empowers individuals to make the most of their financial resources while keeping within their set budget.

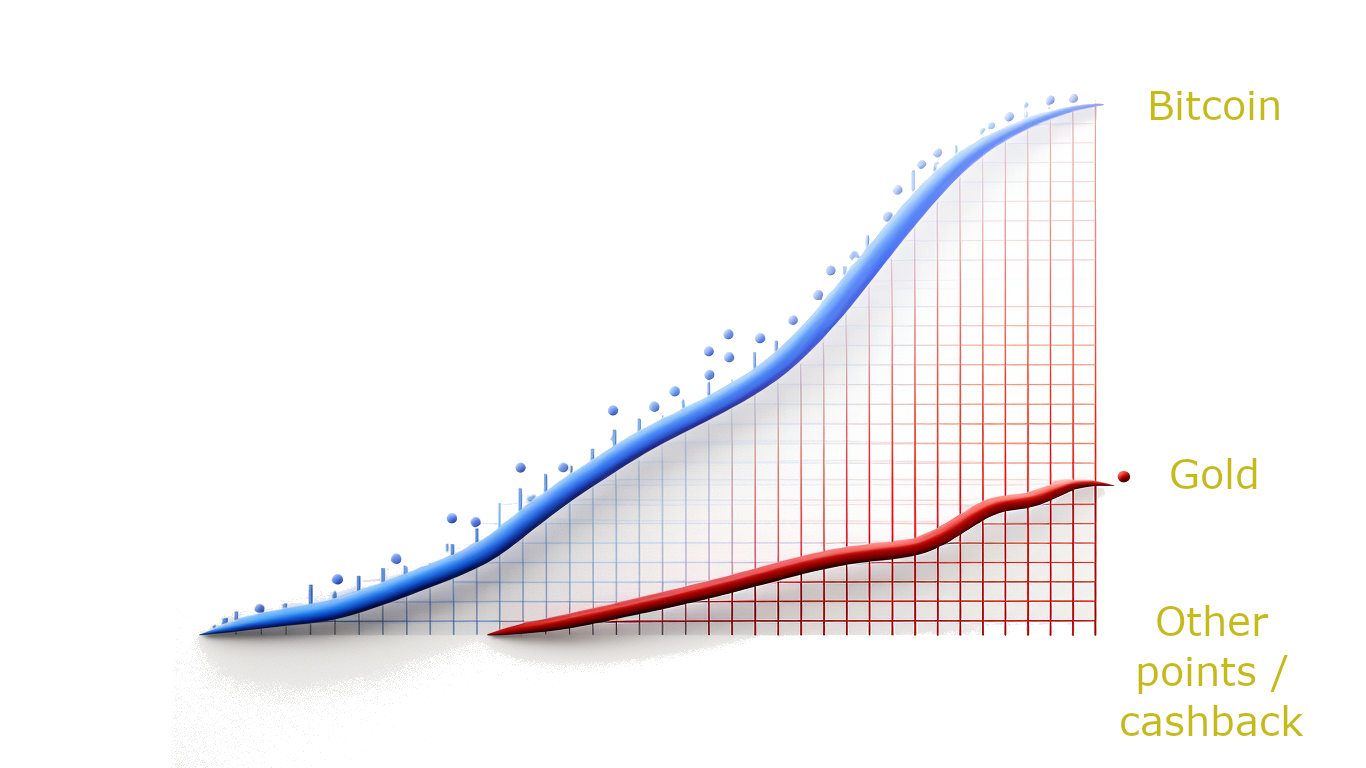

Moreover, X Card's unwavering focus on security makes it the ideal choice for the savvy spender. With the assurance of limited exposure to potential theft or unauthorized transactions, users can navigate their financial journey with peace of mind. Anq's commitment to providing a transparent and secure platform further solidifies its position as the best choice for those seeking financial stability and control. With X Card, users can embrace a prepaid card that not only aligns with their smart money management approach but also opens the doors to exclusive rewards and bounties, enhancing their financial prosperity.

In essence, X Card transcends the limitations of traditional credit and debit cards, offering the ideal blend of financial control, security, and rewarding experiences. By leveraging the power of prepaid cards, Anq empowers individuals to take charge of their financial destiny, making prudent choices that pave the way for a brighter and more prosperous future. With X Card in hand, the savvy consumer can navigate the financial landscape with confidence, unlocking the full potential of their wealth-building journey.

Prepaid cards are a savvy way to budget, build credit, protect identity, and avoid fees.

Budgeting: With a prepaid card, you can only spend the amount of money that you have loaded onto the card, so you're less likely to overspend. This can help you stay on track with your budget and avoid debt.

Building credit: Some prepaid cards report your spending activity to the credit bureaus, which can help you build your credit history over time. This can make it easier to qualify for loans and other forms of credit in the future.

Protecting identity: When you use a prepaid card, you don't have to share your personal financial information with merchants, which can help protect your identity from fraud. This is especially important if you're shopping online or using your card in a foreign country.

Avoiding fees: Prepaid cards can help you avoid overdraft fees and other fees that can often be associated with traditional credit and debit cards. This can save you money in the long run.