Unveiling the Mysteries: How Gold Prices are Decided

Gold, an illustrious and cherished precious metal, has been captivating humanity's fascination for millennia. Its allure is not only confined to its intrinsic beauty but also to its inherent value and use as a store of wealth. As an investor or someone curious about the financial markets, have you ever wondered how the price of this radiant metal is determined? Let's delve into the captivating world of gold and demystify how its prices are decided.

- Global Demand and Supply Dynamics: One of the fundamental factors influencing gold prices is the interplay between global demand and supply. Gold is not only a precious metal adored for jewelry and adornments, but it also serves as a safe-haven asset and is used in various industries, including electronics and dentistry. Fluctuations in demand and supply, driven by factors such as economic conditions, geopolitical uncertainties, and industrial usage, can significantly impact gold prices.

- Financial Market Sentiments: Gold often acts as a hedge against economic uncertainties and financial market volatilities. As a result, investor sentiment plays a vital role in driving gold prices. In times of economic distress or geopolitical tensions, investors tend to seek refuge in gold, driving its demand and pushing prices higher.

- Inflation and Currency Value: Gold's role as a protector against inflation is well-established. When inflation rises, the purchasing power of fiat currencies declines, making gold relatively more attractive as a store of value. Consequently, gold prices tend to increase in response to higher inflation rates or weakening currency values.

- Central Bank Policies: The actions of central banks, especially in relation to interest rates and monetary policies, can influence gold prices. When central banks implement accommodative monetary policies or reduce interest rates, it can weaken fiat currencies, leading investors to seek shelter in gold, thus driving up its prices.

- Market Speculation and Trading: Like other financial assets, gold is subject to speculation and trading activities in global markets. Traders and speculators often engage in buying and selling gold contracts, which can lead to short-term fluctuations in prices. However, in the long run, fundamental factors tend to dominate gold price movements.

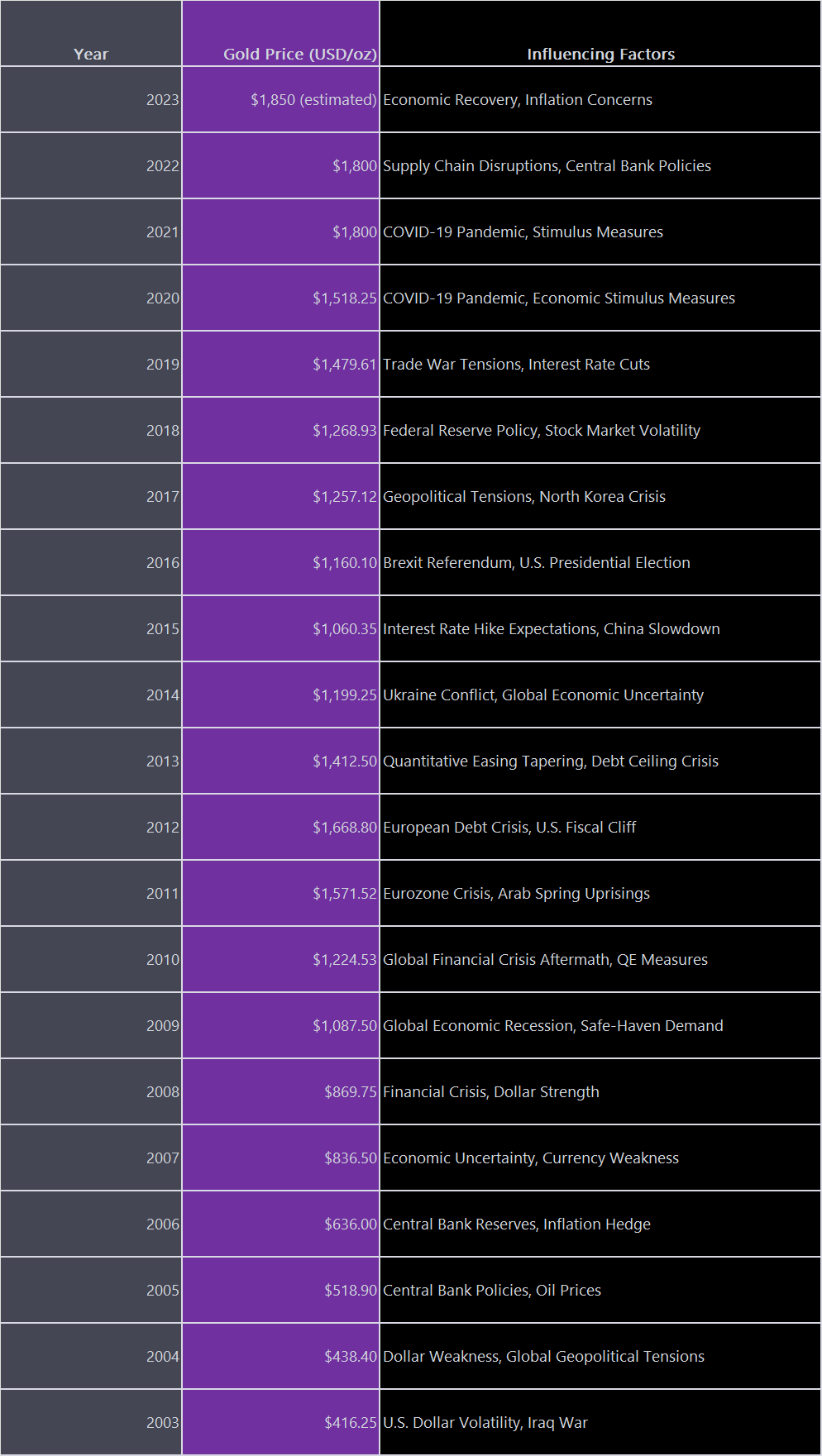

Here is a table showcasing gold prices year over year and global events determining the same or influencing the same:

The table provides a comparison of gold prices over the last 20 years, along with the key influencing factors. Gold prices are affected by a complex interplay of economic, geopolitical, and financial market dynamics. Events such as economic recessions, geopolitical tensions, changes in interest rates, monetary policies, currency fluctuations, and market uncertainties can all impact gold prices. Additionally, gold is often considered a safe-haven asset during times of economic turmoil and uncertainty, leading to increased demand and price appreciation. As investors seek to diversify their portfolios and protect against inflation, gold continues to play a significant role as a store of value and a hedge against various risks.

Why X Card by Anq - Your Gateway to Gold?

In this shimmering world of gold, X Card by Anq emerges as a unique and powerful financial tool, offering you the ability to seamlessly access gold as rewards with every spend. Unlike traditional credit or debit cards, X Card empowers you to earn bounties in the form of real gold on every transaction you make. As you spend, you accumulate gold, thereby building a precious metal portfolio without any extra effort.

With X Card, you unlock the potential to preserve and grow your wealth through gold, irrespective of market conditions. While credit cards may lure you with cashback rewards or reward points subject to various limitations and conditions, X Card ensures that your rewards are substantial and tangible. Your bounties in gold are market-linked, offering the potential for value appreciation, making it an attractive investment avenue.

Moreover, as a prepaid card, X Card enables you to spend within your means and maintain better financial discipline. It empowers you with control over your spending, avoiding unnecessary debt burdens associated with credit cards. With no interest charges or hidden fees, X Card presents a smarter way to manage your finances while accumulating the timeless value of gold.

In a world where financial choices matter, X Card stands out as a beacon of financial empowerment, marrying the brilliance of gold with the convenience of a prepaid card. It paves the way for a secure, rewarding, and disciplined financial journey, ensuring you shine bright amidst economic uncertainties.

So, if you seek a card that understands your financial aspirations and unlocks the true potential of gold, X Card by Anq is your golden ticket to a radiant future.

(Note: The comparison table provided below showcases a brief overview of X Card's advantages over credit and debit cards in terms of features and benefits.)

| Card Type | Accumulate Gold Rewards | Interest Charges | Hidden Fees | Controlled Spending |

|---|---|---|---|---|

| Anq X Card | ✔️ | ❌ | ❌ | ✔️ |

| Credit Card | ❌ | ✔️ | ❌ | ❌ |

| Debit Card | ❌ | ❌ | ❌ | ❌ |

Where will the price of gold go in the next 10 years?

It is difficult to predict where the price of gold will go in the next 10 years. However, some analysts believe that the price of gold could reach $3,000 per ounce by 2030. This is based on the assumption that economic uncertainty and inflation will continue to be major concerns for investors.

Other analysts believe that the price of gold will remain relatively stable in the next 10 years. They argue that the rise of digital currencies, such as Bitcoin, could compete with gold as a store of value.

Ultimately, the future price of gold will depend on a number of factors, including the global economy, inflation, and central bank policies. However, gold is likely to remain a valuable asset for investors in the years to come.

This article is not investment advice. The information contained in this article is for informational purposes only and should not be construed as financial advice. You should always consult with a qualified financial advisor before making any investment decisions.