Gold: The Time-Tested Hedge Against Inflation

As investors around the world grapple with rising inflation rates, many are looking for safe haven assets that can protect their wealth. One such asset that has stood the test of time as a hedge against inflation is gold. In this blog, we'll explore why gold is an especially convincing investment during times of inflation and how it can help investors protect their wealth.

Firstly, it's important to understand the impact of inflation on investments. Inflation is a phenomenon where the general level of prices for goods and services is rising, which means that the purchasing power of money is decreasing. This can lead to a decrease in the value of investments that are denominated in a currency that is experiencing inflation. For example, if the rate of inflation is 3%, an investment that generates a 2% return would actually be losing value in real terms.

Gold has been a popular investment during times of inflation because it has maintained its value over time. Unlike paper currencies, which can be printed in large quantities and lose value, gold has a finite supply. This scarcity makes gold a convincing resource that retains its value, even during times of economic uncertainty.

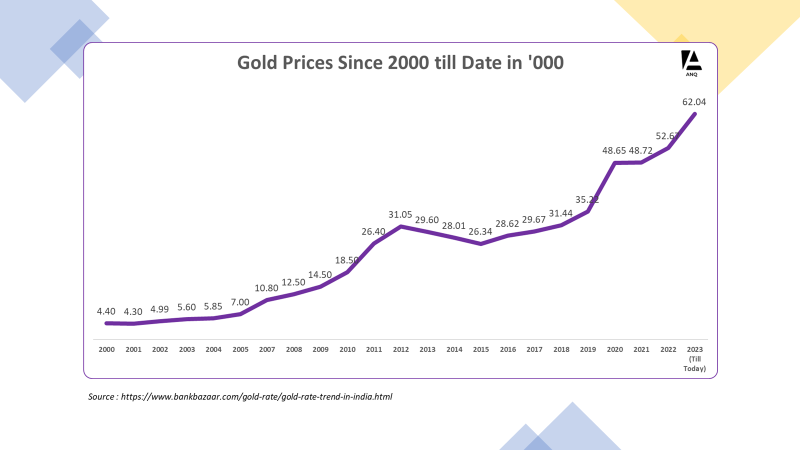

Historically, gold has proven to be an effective hedge against inflation. For example, during the 1970s, when inflation rates in the US were soaring, the price of gold also increased significantly. In fact, between 1971 and 1980, the price of gold increased from $35 to $850 per ounce, a nearly 24-fold increase.

One of the key reasons why gold is a convincing investment during times of inflation is that it is not tied to any particular currency. This means that the price of gold can rise even if the value of the currency it is denominated in is declining. In addition, gold is a globally recognized asset that can be easily traded and sold, making it a highly liquid asset that investors can use to quickly respond to changes in the market.

Moreover, gold has a low correlation with other asset classes, such as stocks and bonds. This makes it an ideal addition to a diversified portfolio, which can help reduce overall investment risk.

However, it's important to note that the relationship between gold and inflation is not always straightforward. Other factors such as interest rates, geopolitical tensions, and global economic growth can also impact the price of gold. As a result, investors should not rely solely on gold as a hedge against inflation, but instead should consider a diversified investment portfolio that includes a range of assets such as stocks, bonds, and commodities.

In conclusion, gold is a highly convincing investment during times of inflation because it has historically proven to be a safe haven asset that retains its value. It's an asset that's not tied to any particular currency and can easily be traded and sold. Furthermore, its low correlation with other asset classes makes it an excellent addition to a diversified portfolio. As always, investors should consult with a financial advisor to determine the appropriate allocation of assets based on individual investment goals and risk tolerance.

Earning gold against every spend is a convenient and passive way to build up your investment portfolio. With Anq bounties, a percentage of each purchase you make on your day to day need is automatically converted into gold and added to your portfolio. This strategy can help diversify your portfolio, protect against inflation, and accumulate gold over time without large lump sum investments.

Adding a small percentage of bitcoin to your investment portfolio can be a way to further diversify your holdings and potentially increase your returns over the long term. However, as with any investment, it's important to do your research and carefully consider the risks before making a decision.

Anq bounties provides your the flexibility to change mode between Gold or Bitcoin anytime every time. Join Anq today to diversify further and earn return while you spend www.anq.finance/app