Gold and Bitcoin: A Powerful Investment Hedge

In a world of economic uncertainties and market volatility, investors often seek assets that can serve as reliable hedges to protect their wealth. Gold and Bitcoin have emerged as popular choices due to their unique properties and historical performance. This blog explores why these two assets, with their distinct characteristics, can potentially provide a solid hedge against various investment risks.

Gold: A Timeless Store of Value

For centuries, gold has been regarded as a store of value and a safe haven asset during times of economic turbulence. Here's why it continues to be an attractive hedge for investors:

- Stability in Turbulent Times: Gold has historically demonstrated an inverse relationship with other assets, such as stocks and currencies. When traditional markets experience downturns or geopolitical uncertainties arise, gold tends to retain its value or even appreciate. This stability can provide a valuable cushion for investors during times of market volatility.

- Inflation Hedge: Gold has long been recognized as an effective hedge against inflation. As the money supply expands and the purchasing power of fiat currencies declines, gold tends to maintain its value or increase in price. This property makes it an attractive asset for preserving wealth over the long term.

- Tangible Asset: Unlike digital currencies or financial instruments, gold is a physical asset that has inherent value. Its scarcity, durability, and universal acceptance provide a sense of security and trust. Investors appreciate the tangibility of gold, as it is not subject to the same risks as purely digital assets.

Bitcoin: The Digital Gold

Bitcoin, often referred to as "digital gold," has gained prominence as a hedge against market risks and a potential store of value. Here's why it has captured the attention of investors:

- Decentralization and Limited Supply: Like gold, Bitcoin operates on a decentralized network, making it resistant to censorship and manipulation. Bitcoin's scarcity is predetermined, with a maximum supply of 21 million coins. This limited supply, combined with increasing demand, has the potential to drive its value higher over time, similar to gold.

- Hedge Against Inflation and Fiat Currency Depreciation: Bitcoin's decentralized nature and finite supply make it an attractive hedge against inflation and the potential depreciation of fiat currencies. As central banks continue to engage in monetary stimulus and print more money, the appeal of a digital currency that cannot be inflated or devalued becomes evident.

- Diversification Benefits: Including Bitcoin in an investment portfolio can provide diversification benefits. Its price movements are not always directly correlated with traditional assets like stocks or bonds, adding an additional layer of risk management. Bitcoin's relatively low correlation with other asset classes makes it an appealing addition to a well-diversified portfolio.

- Potential for High Returns: Bitcoin's price history shows its potential for substantial returns. While past performance does not guarantee future results, Bitcoin has delivered impressive gains over the years. However, it is important to note that Bitcoin's price volatility can result in significant short-term fluctuations, highlighting the need for careful risk management.

Conclusion

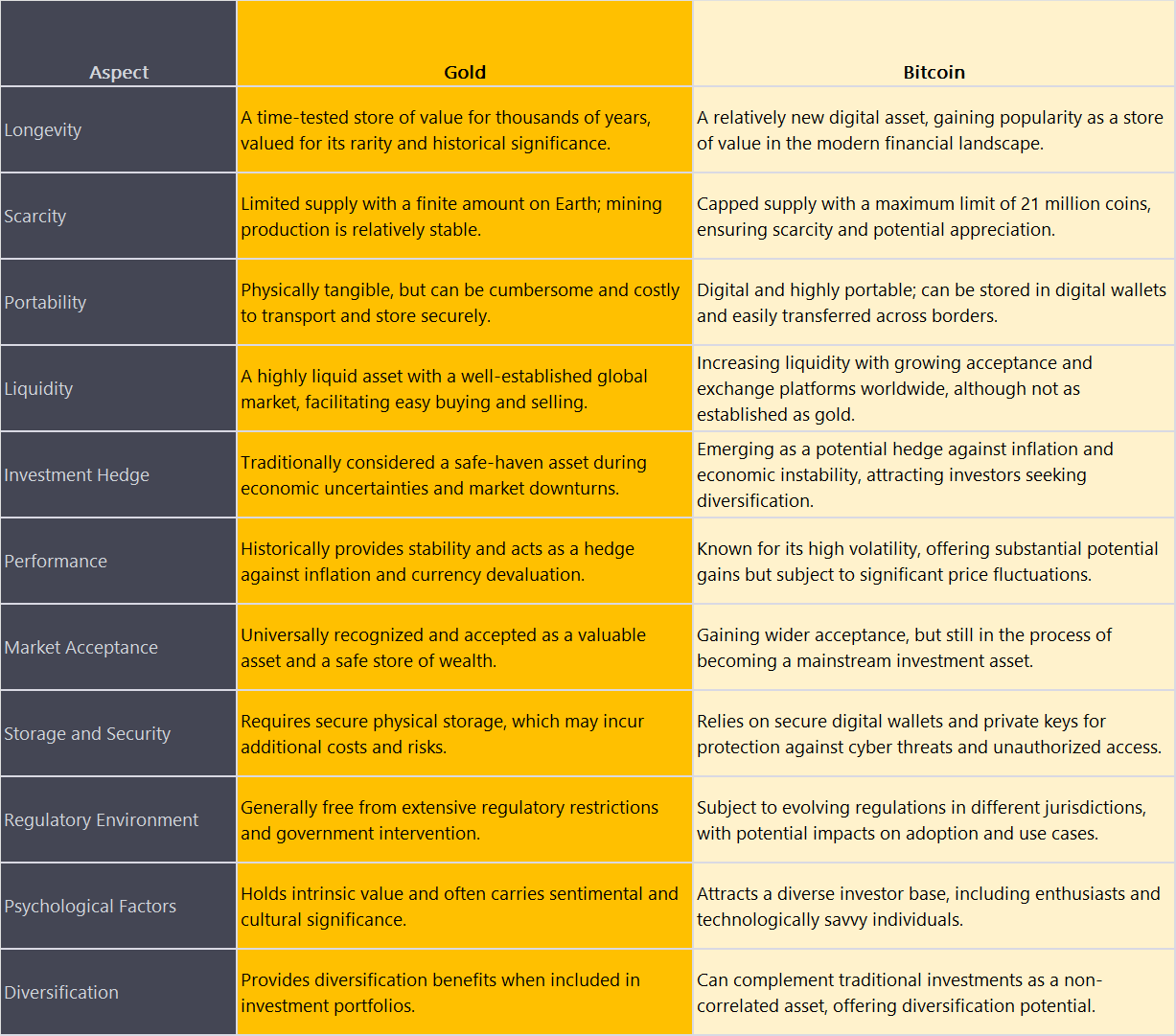

Both gold and Bitcoin offer unique characteristics that make them attractive investment hedges. Gold's long-standing history as a store of value and its stability during uncertain times provide a sense of security for investors. Bitcoin, on the other hand, offers the advantages of decentralization, limited supply, potential for high returns, and the ability to hedge against inflation and fiat currency depreciation.

While gold and Bitcoin have demonstrated their hedging capabilities, it is essential to consider individual investment goals, risk tolerance, and time horizons before allocating capital to these assets. Diversification, thorough research, and professional advice should guide investors in building a well-rounded portfolio that incorporates both traditional and alternative assets, including gold and Bitcoin, to mitigate risks and maximize potential returns.

There are multiple ways to invest in gold or Bitcoin, one innovative approach is to leverage platforms like Anq that allow you to earn these assets as rewards against your everyday spending. By utilizing Anq's services, each transaction you make effectively acts as a systematic investment plan (SIP) into gold or Bitcoin, providing a passive and consistent hedge within your investment portfolio.