Financial Stability Risks Rise Amid Tighter Monetary Conditions and Geopolitical Tensions

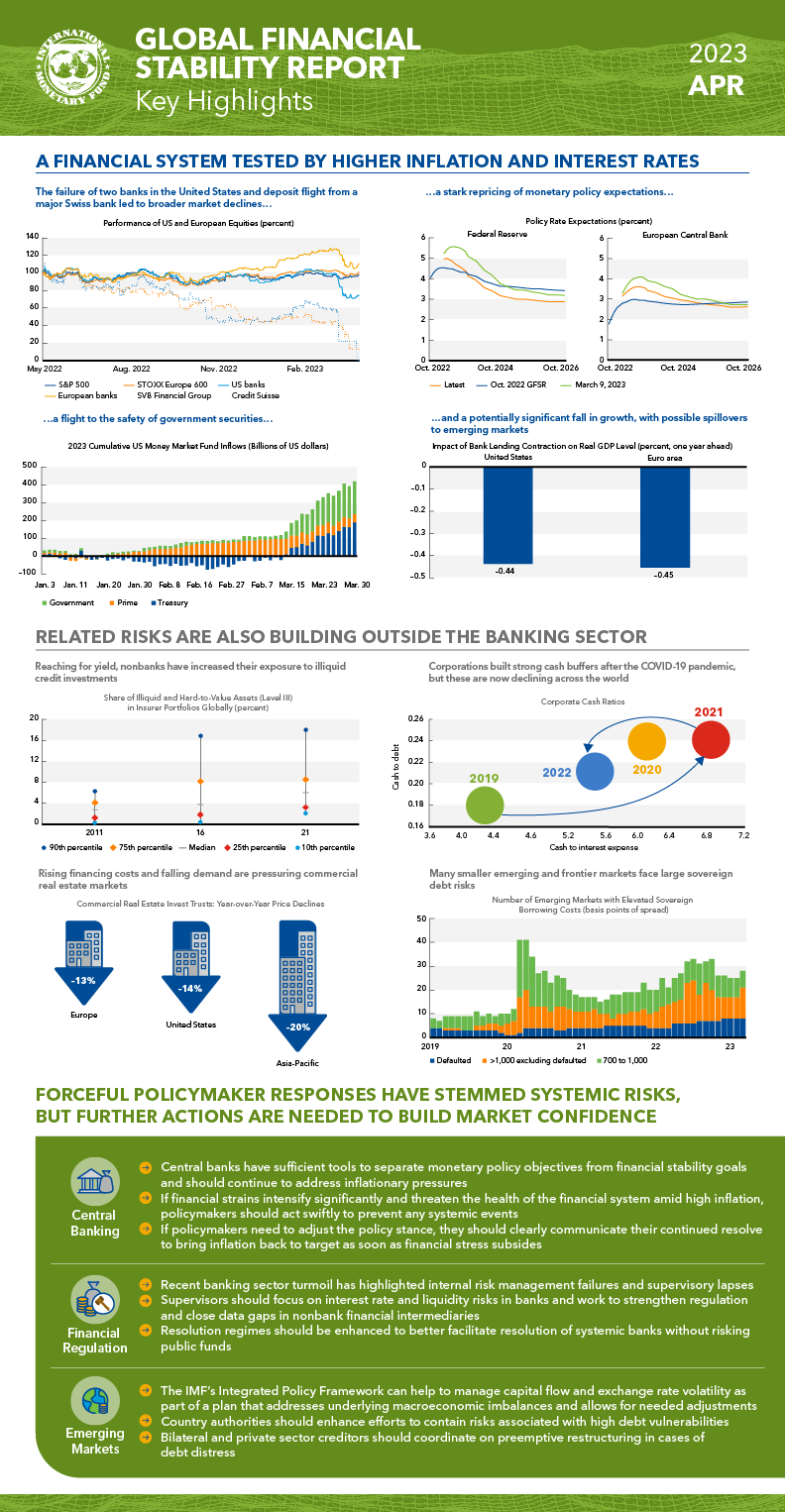

The global financial system is facing a number of challenges in 2023. Rising inflation, tighter monetary conditions, and geopolitical tensions are all weighing on financial stability.

Inflation

Inflation has been rising sharply in recent months, driven by a number of factors, including the war in Ukraine, supply chain disruptions, and strong demand. In the United States, inflation reached a 40-year high of 8.5% in March 2023.

Rising inflation is putting pressure on central banks to tighten monetary policy. The US Federal Reserve has already raised interest rates twice in 2023, and is expected to raise rates several more times this year. Other central banks, such as the European Central Bank, are also expected to tighten monetary policy in the coming months.

Here are some key statistics on global inflation:

- Inflation in the United States: 8.5% (March 2023)

- Inflation in the euro area: 7.5% (March 2023)

- Inflation in China: 2.1% (March 2023)

- Inflation in India: 7.79% (March 2023)

Tighter Monetary Conditions

Tightening monetary conditions could have a number of negative consequences for financial stability. Higher interest rates could make it more difficult for borrowers to service their debts, and could lead to defaults. Tighter financial conditions could also lead to a slowdown in economic growth, which could further increase financial stress.

Here are some key statistics on global monetary conditions:

- US Federal Reserve interest rate: 0.75% (as of July 2023)

- European Central Bank interest rate: -0.50% (as of July 2023)

- Bank of England interest rate: 1.25% (as of July 2023)

- Bank of Japan interest rate: -0.10% (as of July 2023)

The outlook for global monetary conditions is uncertain. Monetary policy is likely to remain tight in the near term, but it is possible that central banks will ease monetary policy in 2024 if inflation begins to decline. The pace of monetary policy tightening will depend on a number of factors, including the course of the war in Ukraine, the resolution of supply chain disruptions, and the pace of economic growth.

Geopolitical Tensions

The war in Ukraine is also a major risk to financial stability. The war has led to a sharp increase in energy prices, and has also disrupted global trade. The war could also lead to a further increase in geopolitical tensions, which could have a negative impact on financial markets.

Here are some key statistics on the impact of the Ukraine war on financial markets:

- The S&P 500 index has fallen by more than 10% since the start of the war.

- The yield on the 10-year US Treasury bond has risen from 1.5% to 3.0%.

- The price of Brent crude oil has risen from $90 per barrel to $120 per barrel.

Outlook

The outlook for financial markets in the near term is uncertain. The war in Ukraine could continue for some time, and the sanctions on Russia could have a significant impact on the global economy. The disruption to global trade could also weigh on economic growth.

However, there are some signs that financial markets may be starting to stabilize. The S&P 500 index has rebounded from its recent lows, and the yield on the 10-year US Treasury bond has fallen from its peak.

It is too early to say whether the Ukraine war will have a lasting impact on financial markets. However, the war has certainly highlighted the risks of geopolitical uncertainty and the importance of diversification in investment portfolios.

Nonbank Financial Intermediaries

In addition to these broader risks, there are also some specific risks to financial stability that are worth noting. One such risk is the growing importance of nonbank financial intermediaries (NBFIs). NBFIs are a diverse group of institutions that include hedge funds, private equity firms, and insurance companies. These institutions have grown rapidly in recent years, and now play a significant role in the global financial system.

However, NBFIs are often less regulated than banks, and they may not have the same level of financial buffers. This means that they are more vulnerable to shocks, and could pose a risk to financial stability if they were to fail.

Policy Recommendations

In light of these risks, the IMF has made a number of policy recommendations to help mitigate financial stability risks. These recommendations include:

- Maintaining strong financial regulation and supervision.

- Ensuring that banks have adequate capital buffers.

- Monitoring the health of NBFIs.

- Promoting financial market stability.

The IMF has also called on policymakers to cooperate internationally to address financial stability risks. This is important because financial instability can spread quickly across borders.

Conclusion

The global financial system is facing a number of challenges in 2023. Rising inflation, tighter monetary conditions, and geopolitical tensions are all weighing on financial stability. The IMF has made a number of policy recommendations to help mitigate these risks, and has called on policymakers to cooperate internationally to address these challenges.