Credit on UPI: A Game Changer for Digital Payments in India

The Unified Payments Interface (UPI) introduced by National Payments Corporation of India(NPCI) revolutionized digital payments in India, offering a fast, secure, and convenient way to transfer funds. But what if you could use UPI for more than just transferring existing money? Credit on UPI is making this a reality, allowing users to access instant credit directly through their favorite UPI apps.

What are the Benefits of Credit on UPI?

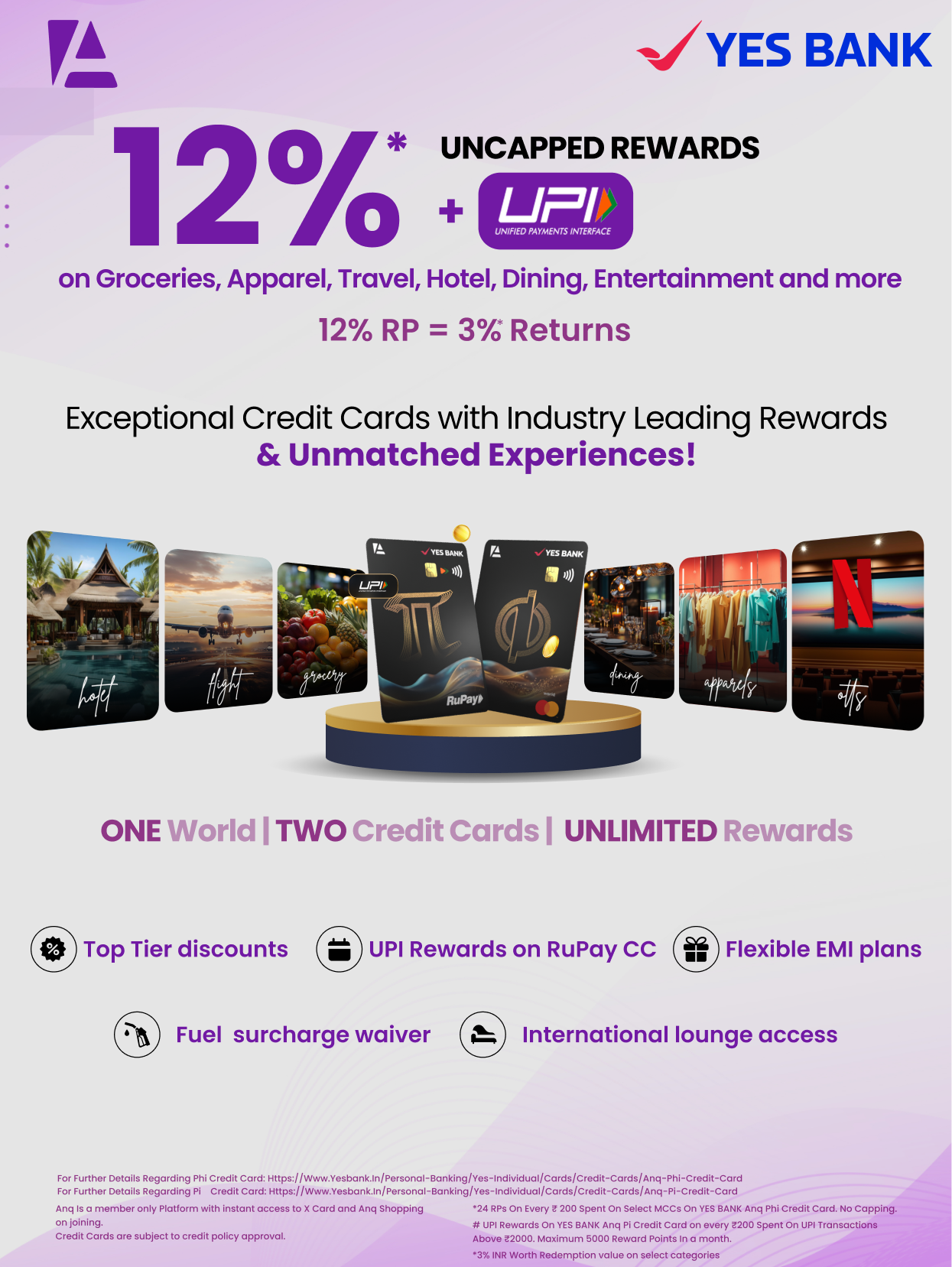

- Seamless Integration: Link your pre-approved credit card to any UPI app (Cred, PhonePe, Google Pay, Paytm etc.) for effortless payments. No need to switch between apps or manage multiple accounts

- Increased Purchasing Power: Make purchases exceeding your bank balance without waiting for the pay day

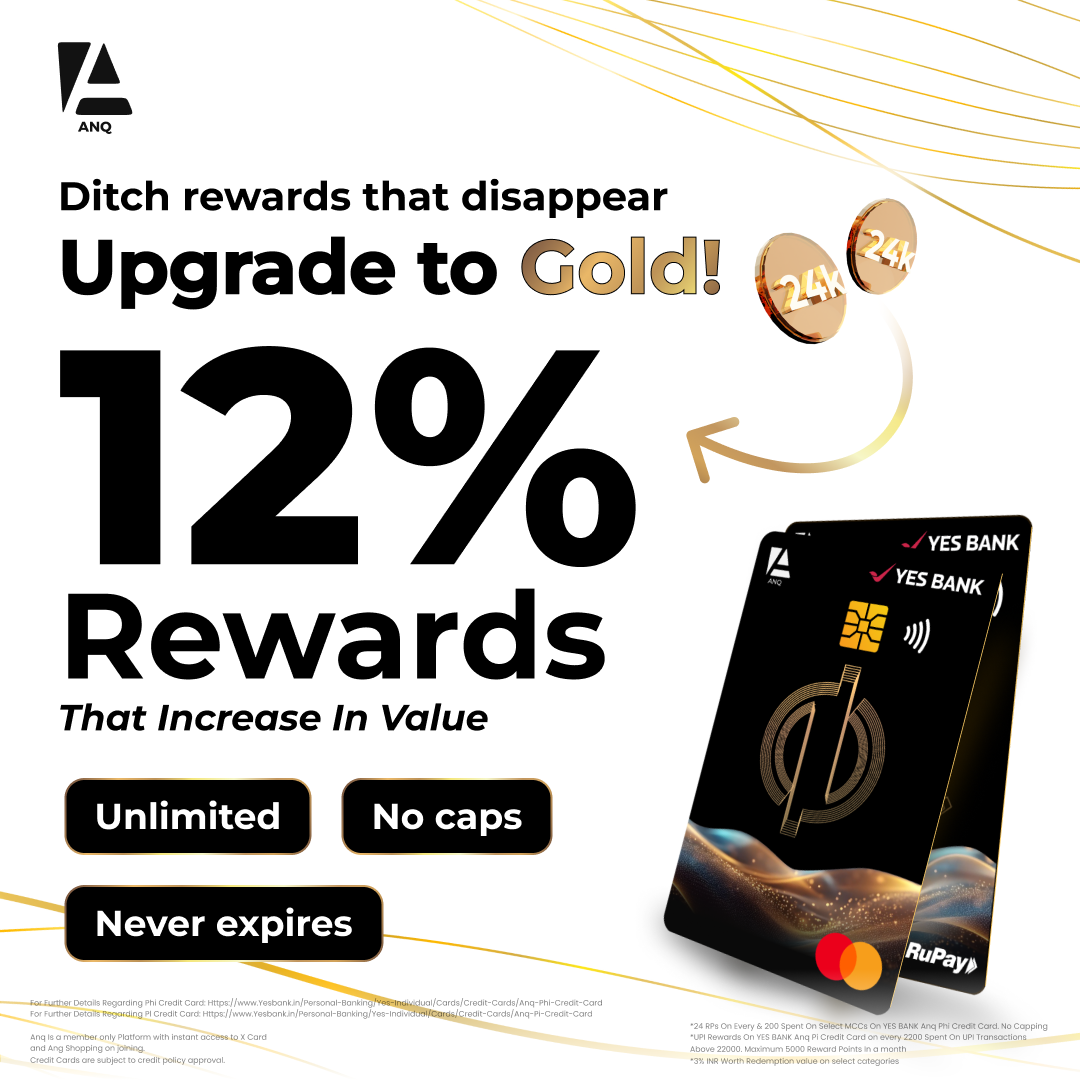

- Rewards and Cashback: Earn points or cashback on your UPI transactions, maximizing the value of your spending

- Improved Financial Management: Track all your expenses, including credit purchases, in a single consolidated statement

- Spend Now Pay Later: Enjoy up to 50 days interest-free grace periods

- Flexible Repayment Options: Seamlessly convert larger purchases into manageable EMIs (Equated Monthly Installments).

How Does Credit on UPI Work?

- Eligibility: Banks assess your creditworthiness

- Linking Credit Line to UPI App: Link your approved credit line to your preferred UPI app through a secure process

- Making Payments: Select the desired credit card during UPI transactions and enter your UPI PIN for authorization.

- Repayment: Settle your credit card balance within the stipulated timeframe to avoid interest charges. You can manage repayments directly through your UPI app or bank portal

Who Can Avail Credit on UPI?

Currently, credit on UPI is offered by select banks based on pre-defined eligibility criteria. This typically includes:

- Age: Typically between 21-60 years

- Minimum Salary: Varies depending on the bank (often ₹25,000 per month or more)

- Credit Score: A good credit history is required for approval.

- Existing liabilities

- Payment behavior on existing credit products

- Recency & take up frequency of different credit products...

Existing Rupay credit card holders can link their card to any UPI App and start using.

Only Rupay users can link their credit card to UPI.

The Changing Landscape of UPI Adoption

With credit on UPI, we're witnessing a significant shift in digital payment adoption. Here's how:

- Boosting Microtransactions: Small and medium businesses can benefit from increased customer spending power through UPI credit

- Enhancing Digital Inclusion: Credit on UPI empowers individuals to manage their finances more effectively and participate more actively in the digital economy

- Enhanced Reachability: Eligible individuals with limited access to credit on demand, can now leverage credit on UPI for various purchases

The Future of Credit on UPI

The future of credit on UPI is bright. As the technology matures and adoption expands, we can expect:

- Wider Availability: More banks are likely to offer credit on UPI, increasing competition and potentially offering even better value & convenience

- Enhanced Security Features: Robust security protocols will ensure safe and secure credit transactions through UPI

- Personalized Offerings: Banks may tailor pre-approved credit limits and reward programs based on individual spending habits

Credit on UPI is a revolutionary step forward, making digital payments even more convenient and accessible. With its numerous benefits for both consumers and businesses, credit on UPI is poised to play a major role in shaping the future of India's digital financial landscape.