Credit card vs X Card

X Card is a prepaid card - this is how it is better!!

| Feature | Credit Card | Prepaid Card |

|---|---|---|

| How it works | You borrow money from the credit card company and then pay it back, with interest, over time. | You load money onto the card in advance and then spend that money. |

| Credit building | Using a credit card responsibly can help you build your credit score. | Prepaid cards do not help you build your credit score. |

| Liability for fraud | If your credit card is lost or stolen, you are only liable for up to $50 in fraudulent charges if you report the loss within 60 days. | If your prepaid card is lost or stolen, you are only liable for the amount of money that was on the card at the time it was lost or stolen. |

| Fees | Credit cards typically have annual fees, late payment fees, and foreign transaction fees. | Prepaid cards can have fees for loading the card, using the card at ATMs, and making international transactions. |

| Availability | Credit cards are widely available. | Prepaid cards are available at most retail stores and online. |

Advantages of prepaid cards over credit cards

- No credit check required. Anyone can get a prepaid card, even if they have bad credit.

- No debt. You can only spend the money that you have loaded onto the card, so you can't overspend and end up in debt.

- Good for budgeting. Since you can only spend the money that you have loaded onto the card, prepaid cards can be a good way to budget your spending.

- More secure. If your prepaid card is lost or stolen, the thief can only spend the money that was on the card at the time it was lost or stolen. With a credit card, the thief could potentially spend more money than you have in your account.

Ultimately, the best type of card for you will depend on your individual needs and circumstances. If you are looking for a way to build your credit score or earn rewards, a credit card may be a better option for you. However, if you are looking for a way to budget your spending or protect yourself from debt, a prepaid card may be a better choice.

HDFC credit cards vs X Card

HDFC Credit Cards

HDFC credit cards offer a wide range of features and benefits, including welcome bonuses, reward points, travel benefits, and other perks. The annual fees for HDFC credit cards vary by card, but they are generally quite reasonable.

X Card by Anq

X Card by Anq is a new prepaid card that offers a simple and straightforward rewards program. You earn FLAT 1% bounties per Rs. 150 spent, and you can redeem your points for air miles, gift cards, merchandise, and more. X Card by Anq does not have an annual fee, and it is available to anyone with good credit.

Which card is right for you?

The best credit card for you will depend on your individual needs and spending habits. If you are looking for a card with a lot of features and benefits, then an HDFC credit card may be a good option for you. If you are looking for a simple and straightforward asset linked rewards program, then X Card by Anq may be a better choice.

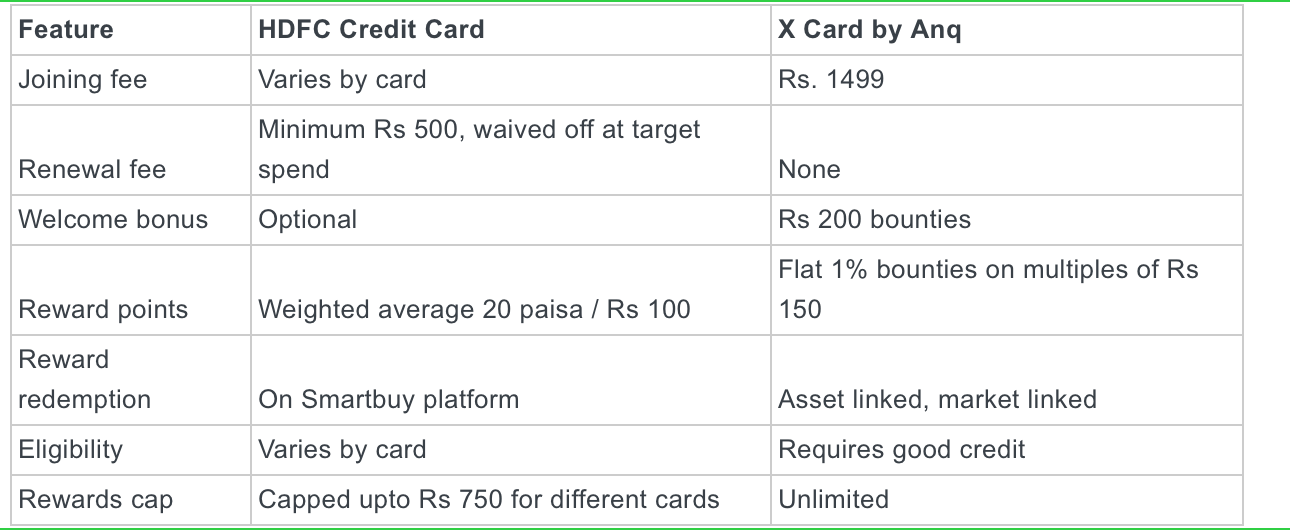

Here is a table that summarizes the key differences between HDFC credit cards and X Card by Anq:

And bounties as your assets grow. Reward points don't.

SBI Card vs X Card

- No annual fee. X Card by Anq does not have an annual fee, while many SBI Credit Cards do. This can save you a significant amount of money over time.

- Simple rewards program. X Card by Anq offers a simple and straightforward rewards program. You earn FLAT 1% bounties in GOLD / BTC per Rs. 150 spent. This is in contrast to many SBI Credit Cards, which have more complex rewards programs that can be difficult to understand.

- Widely accepted. X Card by Anq is accepted by a wide range of merchants, including online retailers, brick-and-mortar stores. This means that you can use your card wherever you want, without having to worry about it being accepted.

- Easy to apply for. You can apply for X Card through the Anq app. The application process is quick and easy, and you can usually get approved within minutes.

- Good customer service. Anq has a good reputation for customer service. If you have any problems with your card, you can be sure that Anq will be there to help you.

Of course, there are also some advantages to SBI Credit Cards. For example, some SBI Credit Cards offer more travel benefits than X Card by Anq. However, overall, X Card by Anq offers a more attractive package for most people.