Beyond Plastic Promises: Why Prepaid Cards Outshine Credit, and How Anq X Leads the Charge

The allure of the credit card is undeniable. It promises convenience, rewards, and a safety net for emergencies, all wrapped in a sleek piece of plastic. For decades, it has been the cornerstone of consumer spending, a symbol of financial adulthood. But beneath this polished veneer lies a complex system, one that often benefits the issuer more than the user. It's time to pull back the curtain and explore a more empowering alternative: the prepaid card, a tool that offers genuine financial control. And at the forefront of this evolution is the Anq X card, a product designed not just for spending, but for smart saving and wealth building.

1. The Credit Card Conundrum: Are You Really Winning?

Credit cards have become deeply embedded in the financial fabric of modern life, offering the immediate gratification of "spend first, pay later".This model, combined with promises of rewards, purchase protection, and the ability to build a credit history, makes them an attractive proposition for many. However, this convenience often comes at a steep, and sometimes hidden, price.

One of the most insidious aspects of credit card use is the "minimum due trap".Card statements prominently display a minimum payment amount, leading many users to believe this is all they are obliged to pay. In reality, this small payment often barely covers the interest accrued, with little impact on the principal debt. This can create a false sense of low liability, encouraging further spending and quickly spiraling into a cycle of mounting debt.The financial structure of credit cards often thrives on this, as users who don't pay their balance in full become profitable sources of interest revenue for the issuers.

The interest rates themselves are a significant burden. If the full balance isn't cleared by the due date, the outstanding amount begins to accumulate interest at rates that can be alarmingly high. An average rate of 3% per month, equating to a staggering 36% per annum, is not uncommon.This means that the actual cost of purchases made on credit can far exceed their sticker price if balances are carried over.

Beyond interest, credit cards come with a host of other charges. These can include annual fees, late payment penalties, fees for cash advances, processing fees, and even renewal fees.These costs can quickly add up, often negating any rewards earned. The very rewards designed to attract users can become a psychological distraction, masking the true net cost of using the card if interest and fees are consistently incurred.

The "spend first, pay later" model also has a distinct psychological impact. With no immediate depletion of a bank balance, it can be tempting to put all purchases on a card, leading to a disconnect from actual expenditure and making it easy to overspend.This can result in users owing more than they can comfortably repay, initiating a difficult cycle of debt.

While responsible credit card use can help build a positive credit score, the reverse is also true. Missed payments or maintaining a high credit utilization ratio—often a consequence of overspending—can severely damage an individual's creditworthiness, impacting future financial prospects.Finally, though not unique to them, credit cards carry the risk of fraud, adding another layer of potential concern for users.

2. Enter the Prepaid Paradigm: Financial Control Reimagined

In stark contrast to the potential pitfalls of credit, prepaid cards operate on a fundamentally different and more empowering philosophy: "pay first, spend smart".A prepaid card is loaded with funds by the user, and spending is strictly limited to this pre-loaded amount.This simple mechanism brings a wealth of advantages, positioning prepaid cards as a superior tool for modern financial management.

The most profound benefit is debt-free spending. Because users are spending their own money, there is no borrowing involved. This means no accumulation of debt and, crucially, no interest charges.This single feature eliminates the primary source of financial stress associated with credit cards.

Prepaid cards also enforce iron-clad budget management. Since spending cannot exceed the loaded amount, the card itself acts as an automatic budgeting tool, preventing overspending and helping users adhere to their financial plans.This inherent control fosters a more conscious approach to spending, as users are always aware of their available funds.

While some prepaid cards may have nominal issuance or reload fees, they generally lack the complex and often punitive fee structures of credit cards.Users are typically spared the anxiety of unexpected interest charges or a barrage of hidden penalties. This transparency contributes to a more predictable and manageable financial experience.

A significant advantage is their accessibility. Unlike credit cards, which require a good credit score for approval, prepaid cards are generally available to everyone, regardless of their credit history.This makes them an inclusive financial tool, providing access to digital payments for individuals with poor or no credit, or those who simply prefer not to undergo credit checks. This accessibility is a powerful force for financial inclusion, enabling participation in the digital economy for those who might otherwise be excluded by traditional credit systems.

Prepaid cards have evolved far beyond simple gift cards. Modern open-loop prepaid cards, often branded with Visa or Mastercard, offer immense versatility and convenience. They can be used for online and offline purchases, bill payments, and ATM cash withdrawals, much like debit or credit cards.Specialized prepaid cards cater to specific needs, such as forex cards for international travel, which offer benefits like locked-in exchange rates and lower transaction fees compared to credit or debit cards.They are also increasingly used for salary disbursements, particularly for gig economy workers or those without traditional bank accounts, further underscoring their role in financial inclusion.

3. The Anq X Card: Revolutionizing Your Relationship with Money

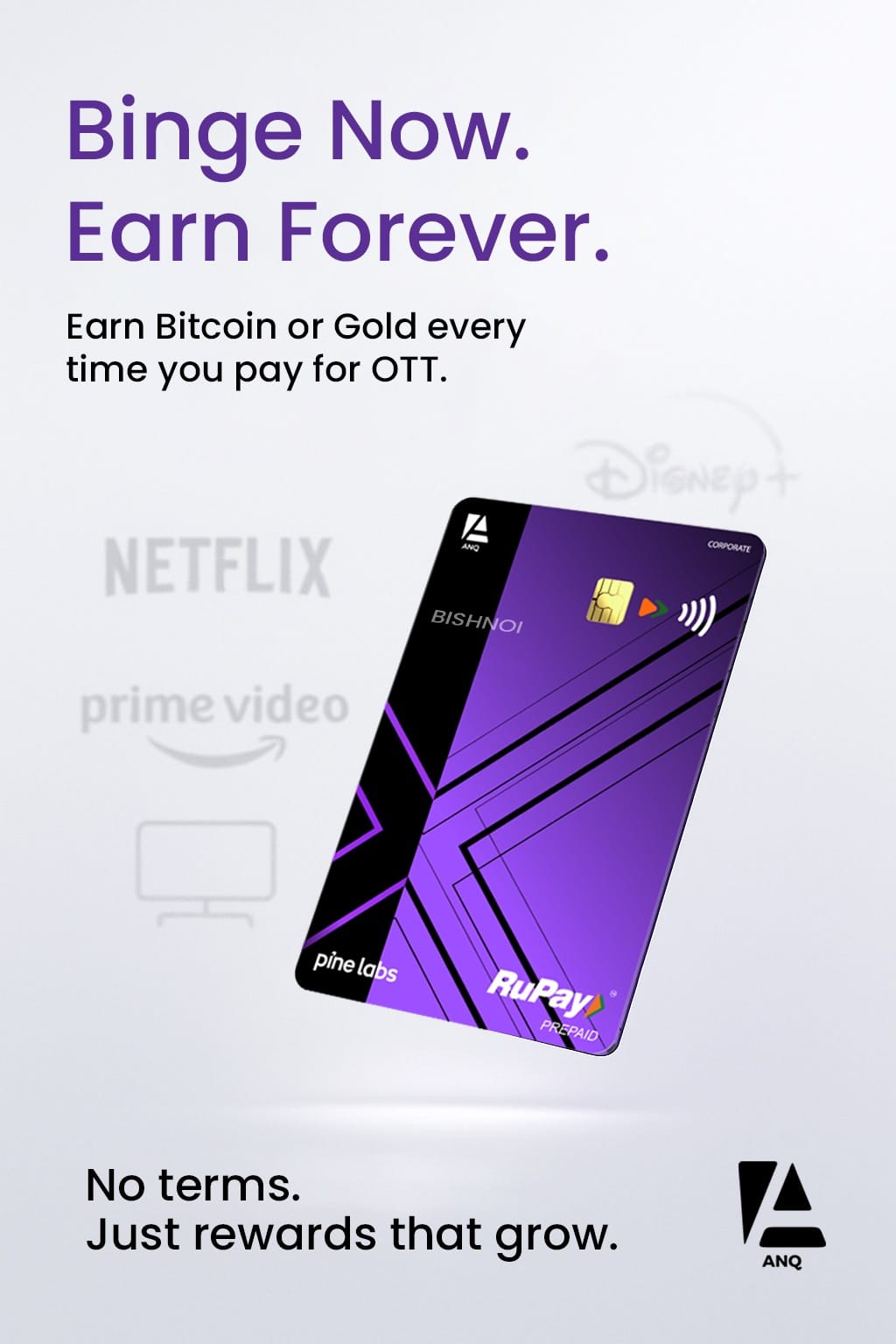

Emerging from the innovative landscape of digital finance, Anq presents itself as a platform powered by decentralized finance (DeFi) principles, aiming to help users make their spending contribute to long-term financial goals like early retirement by converting spends into assets.At the heart of its offering is the Anq X Card, a prepaid card designed to be a "National Common Mobility Enabled One Prepaid Card for All".

The Anq X Card emphasizes seamless onboarding and usage. Users can reportedly acquire the card within two minutes by downloading the Anq app, completing a one-time payment and KYC process, and receiving a digital card instantly, with a physical card to follow within a week.A standout feature is the ability to load the card with funds using UPI at zero charge.This addresses a common pain point of some prepaid cards – reload fees – and leverages India's ubiquitous UPI system for maximum convenience and cost-effectiveness, encouraging more frequent and practical day-to-day use.

Once loaded, the card can be used for online and offline transactions across India.Its NCMC (National Common Mobility Card) enablement is a significant unique selling proposition, allowing users to "Travel Smarter with RuPay-On-the-Go across Metro, Buses & Parking, and skip the Ticket Queue".This feature transforms the Anq X Card from a mere payment tool into an integrated solution for daily life, especially for urban commuters, embedding its value into their routines.

Anq also highlights security features for user peace of mind. Cardholders can change their PIN, freeze or block the card, and set transaction limits directly through the app. Furthermore, the "Bounties" earned through the card are protected by military-grade encryption.

4. The 'Bounty' Effect: Why Anq X Rewards Are a True Game Changer

Perhaps the most revolutionary aspect of the Anq X Card is its unique rewards program, termed "Bounties." Unlike traditional points or fleeting cashback, Anq X Bounties are designed as a "source of wealth," allowing users to "generate investments through spends".These Bounties are linked to valuable assets like Digital Gold (24 Karats, MMTC certified) or even Bitcoin, with the platform also mentioning an "Anq coin" linked to a basket of assets.

This approach fundamentally reframes the concept of rewards. Instead of offering simple consumption discounts, Anq aims to turn everyday spending into a micro-investment opportunity. The Bounties earned have the potential to appreciate in value over time, unlike traditional credit card points that often devalue or come with restrictive redemption options and expiry dates.Anq X Bounties, on the other hand, are promoted as having no expiry and no caps, and users may even be able to switch between different reward assets, offering significant flexibility and long-term value.This transforms spending from a mere transaction into a step towards asset accumulation, aligning with Anq's vision of helping spends contribute to financial goals.

The base reward rate is stated as 1% on spends.However, Anq X also offers significantly enhanced Bounties through its Anq Shopping platform and partnerships with various brands. Users can reportedly earn up to 16% or even 25% Bounties on purchases with specific merchants, such as 7% on Swiggy, 3.5% on MakeMyTrip, 5.5% on Hyatt Hotels, and 4% on Marriott Hotels.Anq also runs promotional offers, such as a limited-time offer to earn ₹300 in Bounties for spending ₹15,000, with a portion credited instantly and a bonus amount later.

Table 2: Anq X Card – Features & Bounties at a Glance

| | Card Type | Prepaid, National Common Mobility Card (NCMC) ||

| Acquisition | Via Anq app, 2-min KYC, instant digital card ||

| Loading Funds | UPI at zero charge ||

| Acceptance | Online & offline pan-India (RuPay network) |(dev resp) |

| Security | User-controlled PIN, freeze/block, transaction limits; Military Grade Encryption for Bounties ||

| Core Reward | "Bounties" - earn assets like Digital Gold, Bitcoin ||

| Base Bounty Rate | 1% on spends ||

| Enhanced Bounties | Up to 16%-25% on Anq Shopping / partner brands ||

| Bounty Features | Potential for value growth, no expiry, no caps, switch between assets ||

| One-Time Fee | implies no recurring annual fees thereafter. ||

| NCMC Benefits | Travel on Metro, Buses, Parking ||

5. Anq X Card: Addressing the Real World

Transparency regarding fees is crucial for any financial product. The Anq X Card is described as having a "one-time lifetime fee of just ₹6,99".Other references mention "lifetime free cards (X & Pi)".The most logical interpretation is that there's a single issuance or membership fee for the X card, after which it is free from recurring annual charges. This model, if accurate, presents a compelling value proposition compared to many credit cards that levy annual fees, making the long-term cost of ownership potentially much lower. Coupled with the zero-charge UPI loading, the Anq X card appears to be structured with user cost-saving in mind.

However, it is important to acknowledge the mixed landscape of user feedback. While some users praise the Anq app for a "seamless and secure transaction experience," an "intuitive interface," and "great bonus" rewards, others report significant challenges. These include non-receipt of the physical card even after a considerable time, a complicated app interface, difficulties in linking to UPI apps (though the card itself loads via UPI), tricky and slow fund loading processes, and app crashes.More seriously, some users have alleged non-credit of funds after making payments and unresponsive customer service, leading to accusations of fraudulent practices.

Anq has responded to some of this feedback publicly. For instance, regarding card delivery delays, a developer response cited high demand leading to temporary inventory shortages that were being resolved.For more severe complaints, Anq has encouraged users to contact their support email (help@anq.finance) with specific details.

These operational challenges, juxtaposed with Anq's innovative product vision (asset-backed rewards, DeFi-powered banking), are not uncommon for fintech disruptors navigating rapid growth and high demand. The long-term success of the Anq X card will undoubtedly hinge on its ability to effectively scale operations, refine its app based on user experience, and provide responsive, reliable customer support to match its ambitious offerings.

To this end, Anq has established customer support channels and a grievance redressal mechanism. Users can reach out via email (help@anq.finance) or phone (+91 8050533435).If issues are not satisfactorily resolved by the customer service team within 14 days, there is a provision to escalate the matter to a Nodal Grievance Redressal Officer.The existence of these formal channels is a positive indicator of Anq's commitment to addressing customer concerns.

6. Making the Smart Switch: Why Anq X Could Be Your Best Financial Ally

The case for prepaid cards as a smarter financial tool is compelling. They offer inherent debt avoidance, superior budget control, and greater accessibility compared to their credit-based counterparts. The Anq X card takes these fundamental benefits and elevates them with an innovative rewards system, modern conveniences like free UPI loading and NCMC integration, robust security features, and a potentially favorable one-time fee structure.

The Anq X card is particularly well-suited for a diverse range of individuals:

- Budget-Conscious Individuals: Those who want to manage their spending meticulously and steer clear of debt will find the card's "spend what you load" mechanism invaluable.

- Individuals Wary of Debt/Credit Traps: Anyone who has had negative experiences with credit card debt or wishes to proactively avoid the complexities of interest and hidden fees will appreciate the simplicity and safety of the Anq X prepaid model.

- Rewards Optimizers Seeking Tangible Value: Users disillusioned with traditional points systems that devalue or expire will be drawn to Anq's "Bounties" program, which offers rewards in the form of actual assets like Digital Gold or Bitcoin, holding the potential for growth.

- Tech-Savvy Users & Early Adopters: Those comfortable with digital finance platforms and interested in exploring innovative products linked to DeFi concepts and crypto-assets will find Anq's offerings intriguing.

- Urban Commuters: The NCMC feature provides a tangible daily benefit for those using public transport in enabled cities, streamlining their travel payments.

- Individuals Building/Rebuilding Financial Health: For those who may not qualify for traditional credit cards or prefer a non-credit financial tool, Anq X offers a secure, rewarding, and accessible way to participate in digital transactions.

The Anq X card, by merging the discipline of prepaid finance with the allure of asset-generating rewards, occupies a unique psychological space. It facilitates responsible spending while simultaneously making users feel that their expenditures are contributing to potential wealth creation. This dual appeal—financial prudence combined with growth aspiration—could attract a broader audience than either basic prepaid cards or risk-associated credit cards alone.

Conclusion: A New Chapter in Consumer Finance

The traditional credit card model, with its inherent risks of debt and complex fees, is no longer the undisputed champion of consumer payments. Prepaid cards offer a compelling alternative, championing financial control, transparency, and accessibility. The Anq X card stands out in this evolving landscape, pushing the boundaries of what a prepaid card can be. Its innovative "Bounties" program, which turns spending into an opportunity for asset accumulation, combined with practical features like NCMC integration and free UPI loading, positions it as a forward-thinking financial tool.

While Anq, like many innovators, faces the task of perfecting its operational execution and customer experience in response to early feedback, its vision is clear: to empower users to manage their money more effectively and make their spending work harder for them. For consumers seeking to break free from the potential traps of credit and embrace a more conscious, rewarding, and potentially wealth-building approach to their finances, the Anq X card presents a compelling invitation to explore a new era of empowered spending. Its success could indeed signal a broader shift towards financial products that offer consumers greater control, tangible value, and a more direct stake in their financial future, challenging the long-held dominance of credit-centric models.