Best Platform to Buy Digital Gold In India for 2023

In a rapidly evolving financial landscape, digital gold has emerged as a game-changer, revolutionizing how Indians invest and save. With Anq, the innovative financial empowerment app, digital gold takes on a whole new dimension - it becomes a tangible reward, earned on every spend. In this blog, we'll explore the significance of digital gold in India, and how Anq adds a touch of brilliance to your financial journey, making smart saving and investing more accessible than ever before.

Gold has stood the test of time as one of the most sought-after investment options. Its allure goes beyond just being a wealth creator; it carries a deep sense of auspiciousness, passed down through generations.

What is Digital Gold?

Digital gold is a way to invest in gold without having to physically own it. It is stored in a digital form, and can be bought and sold online. Digital gold is a popular investment option in India, as it offers the same benefits as physical gold, but with the added convenience of being able to buy and sell it online.

How Does Digital Gold Work?

When you buy digital gold, you are essentially buying a certificate that represents a certain amount of gold. This certificate is stored in a digital vault, and you can redeem it for physical gold at any time. The price of digital gold is linked to the price of physical gold, so it will fluctuate in value in the same way.

Why Invest in Digital Gold?

There are many reasons why you might want to invest in digital gold. Here are a few of the most common reasons:

- Security: Digital gold is stored in a secure digital vault, so you don't have to worry about it being stolen or lost.

- Convenience: You can buy and sell digital gold online, 24 hours a day, 7 days a week.

- Liquidity: Digital gold is a liquid asset, so you can easily sell it if you need to.

- Tax benefits: In India, there are no taxes on capital gains from the sale of digital gold.

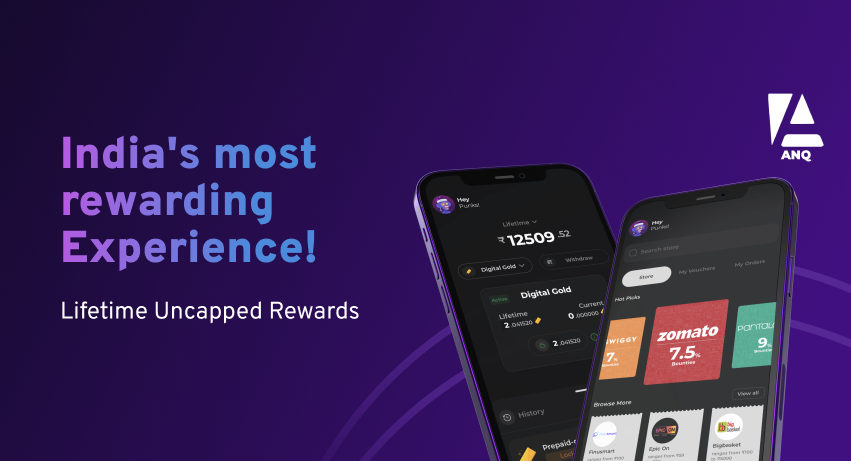

ANQ Bounty

ANQ Bounty is a new digital gold platform that offers a unique way to earn digital gold. When you shop with the ANQ X card, you earn 1% rewards in digital assets, like gold. You can also earn 16% bounties using brand vouchers. This makes ANQ Bounty a great way to earn digital gold while you shop.

Is Digital Gold Safe in India?

Yes, digital gold is safe in India. The government of India has recognized digital gold as a legitimate investment asset, and there are a number of regulated digital gold platforms operating in the country.

Best Platform to Earn / Buy Digital Gold In India

Earn Digital Gold

- Anq : Digital gold is a safe and convenient way to invest in gold. It offers the same benefits as physical gold, but with the added convenience of being able to earn and sell it online. Anq Bounty is a new digital gold reward that offers a unique way to earn digital gold. When you shop with the ANQ X card, you earn 1% rewards in digital assets, like gold. You can also earn 16% bounties using brand vouchers. This makes ANQ Bounty a great way to earn digital gold while you shop. There is no minimum spend or maximum cap on every transaction.

- Gild : Gild is a fixed deposit-backed credit card issued by SBM Bank (India) that allows you to earn high interest rate on your deposit through FDs at the same time it allows you to spend through a linked credit card. Gild also offers a unique rewards program called Petals, which allows you to earn .75% digital gold on every spend. Petals can be redeemed for physical gold or used to purchase products and services from Gild's partners. Gild is a great option for people who are looking for a way to earn interest on their savings while also having the flexibility of a credit card.

Buy Digital Gold

- Koshex : Koshex is a digital wealth platform that allows you to buy, sell, and store gold online. Koshex is a secure and convenient way to invest in gold, and it offers a variety of features that make it a great choice for investors of all levels.

- Jupiter Money: is a personalised money management app that helps you take control of your finances. Apart from tracking your expenses and helping you save in pots, it offers a host of investment alternatives. One of them is digital gold which it offers by partnering with MMTC-PAMP. Through Jupiter Money, you can invest in digital gold with 24K 99.9% purity. You can buy and sell your gold anytime and anywhere with just a swipe. The gold you buy is stored in secured vaults which are free for a lifetime.

- GROWW: Groww is a direct mutual fund and stock investing app. It allows you to invest in financial assets with zero paperwork within a few minutes. To provide gold to its customers, Groww has partnered with Augmont Gold. All transactions that you do for buying and selling digital gold will be directly done with Augmont Gold.

- Paytm / PhonePe / Gpay / AmazonPay / Jar: These are some of other platforms where one can buy and sell digital gold online.

Considerations for Investing in Digital Gold:

- Minimum Investment Flexibility: The minimum investment in digital gold varies among platforms, ranging from as low as Rs 1 to a minimum limit of Rs 100. Choose the platform that suits your investment preferences and budget.

- Maximum Investment Limit: Digital gold allows a maximum investment of up to Rs 2 lakhs. Stay within this threshold to optimize your investment potential.

- Watch for Locker Charges: While most apps do not charge locker fees, it's essential to double-check before investing, as these charges are deducted from your principal amount.

- Holding Period: Digital gold comes with a maximum holding period of five years. After this period, you can either sell it or convert it to physical gold.

- Conversion to Physical Gold: Ensure the platform you choose offers the option to convert digital gold into physical gold if you wish to do so.

- Factor in GST: Keep in mind that digital gold attracts a 3% GST (goods and services tax), deducted from the principal amount. Account for GST when making investment and selling decisions.

- Tax Implications on Capital Gains: When selling your gold, be mindful of taxation. Capital gains on gold are taxable at your applicable income tax slab rate, regardless of the holding period.

What is better - Earning or Buying ?

Earning digital gold on every spend is undeniably superior to traditional investing in digital gold. Unlike conventional investment methods that demand substantial capital upfront, earning digital gold with each transaction requires no significant financial commitment. It presents an opportunity for individuals of all financial backgrounds to participate in the gold investment landscape, democratizing access to this timeless asset. With the ease of Anq's innovative bounty program, users can effortlessly accumulate digital gold over time, turning everyday purchases into a rewarding journey towards financial prosperity.

Furthermore, earning digital gold on spend ensures a tangible connection between your actions and investment growth. Unlike the often abstract nature of traditional investments, where market fluctuations may impact your returns, earning digital gold through Anq's rewards program adds a touch of certainty to your investment journey. With each bounty, users witness their digital gold reserves grow, reinforcing a sense of financial empowerment and motivation to continue making smart spending decisions. This unique approach fosters a more engaging and personally rewarding investment experience, making it an unbeatable choice for those seeking to build wealth while enjoying their daily lives to the fullest.

The Rise of Digital Gold in India: As a nation with a deep-rooted affinity for gold, India has embraced digital gold as a modern way to invest in this precious metal. Digital gold platforms have democratized gold ownership, enabling even those with modest budgets to participate in this age-old investment avenue.

- Empowering Financial Freedom with Anq: Enter Anq, the ultimate financial sidekick! Combining the power of rewards with digital gold, Anq adds a unique twist to the investment landscape. While you make your everyday purchases, Anq rewards you with digital gold, making your spending habits work for your financial future.

- Unveiling the Benefits of Digital Gold: Investing in digital gold has numerous benefits. It offers the convenience of buying, selling, and storing gold online, eliminating the need for physical lockers or concerns about purity. Digital gold platforms are transparent, accessible, and provide easy liquidity, offering flexibility to investors.

- Anq's Bounty - A Golden Opportunity: With Anq, your spending habits become your golden opportunity! As you earn rewards on every spend, Anq converts a portion of those rewards into digital gold, building a treasure chest of wealth over time. This innovative approach empowers you to invest in gold without any extra effort.

- Building a Golden Future: With each bounty earned, your digital gold reserves grow, paving the way for a golden future. Anq makes it effortless to accumulate wealth, ensuring your financial dreams become a tangible reality. You can monitor your digital gold holdings through the app and watch your investments glitter and grow.

- A Gateway to Diversified Savings: Digital gold becomes a part of your diversified savings portfolio with Anq. By earning rewards across various spending categories, you embrace financial flexibility, smart investing, and a brighter financial outlook.

In the digital age, Anq brings financial empowerment and digital gold together, creating a powerful combination that transforms your spending habits into rewarding investments. As India embraces the future of smart saving and investing, Anq stands tall as your gateway to a world of possibilities. Unlock the brilliance of digital gold and secure your financial future with Anq, the ultimate financial sidekick, by your side!